Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Form arts gs is a term that is not commonly used or recognized. It is possible that you may be referring to something else or there may be a typo in the term you provided. If you provide more context or clarify your question, I may be able to provide a more accurate answer.

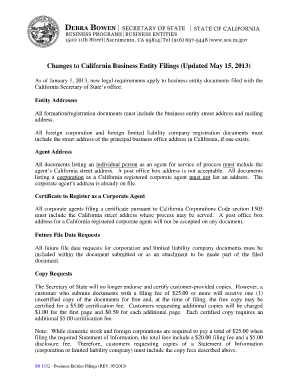

Who is required to file form arts gs?

It is unclear what form "arts gs" refers to. Can you please provide more context or clarify your question?

How to fill out form arts gs?

To fill out Form ARTS GS, follow these steps:

1. Obtain the Form ARTS GS: This form is typically available on the website or platform where you are submitting it. Make sure you have a clean, up-to-date copy of the form.

2. Read the instructions: Before starting to fill out the form, carefully read the provided instructions. Understand the purpose of the form and any specific requirements or guidelines.

3. Fill in personal information: Begin by entering your personal information, such as your full name, address, contact details, and any other requested identification information. Make sure to provide accurate and up-to-date details.

4. Provide business or organization details: If the form requires information related to a business or organization, enter the requested details, including the legal name, address, contact information, and any other relevant identification information.

5. Answer the questions: The form may include a series of questions that you need to answer. Read each question carefully and provide accurate and complete responses. If a question is not applicable to your situation, mark it as "N/A" or leave it blank, depending on the instructions.

6. Attach necessary documents: Check if the form requires any supporting documentation, such as identification proof, certificates, or supporting evidence. Organize and securely attach these documents to the form according to the provided instructions.

7. Review and proofread: Before submitting the form, review all the information you have entered. Make sure there are no spelling mistakes, missing or incorrect information, or any other errors. Proofread the form carefully to ensure accuracy.

8. Sign and date: If the form requires a signature, sign and date it in the designated space, following any specific instructions regarding signatures. If applicable, ensure any other required individuals also sign the form.

9. Submit the form: Depending on the submission process mentioned in the instructions, submit the form electronically (if applicable) or print and mail it to the designated address. If required, make a copy of the filled-out form for your records.

Remember, the specific steps and requirements for filling out Form ARTS GS may vary depending on the organization or agency requesting it. Always carefully read and follow the instructions provided with the form.

What information must be reported on form arts gs?

Form ARTS-GS, also known as the Annual Report for Terminated Organizations, is filed by organizations that have been terminated or have voluntarily dissolved. The information that must be reported on Form ARTS-GS includes:

1. Legal name of the organization: The full legal name of the terminated organization must be stated.

2. Employer Identification Number (EIN): The EIN, also known as the Tax ID number, assigned to the organization by the IRS should be provided.

3. Date of termination or dissolution: The exact date on which the organization was officially terminated or dissolved needs to be reported.

4. Reason for termination: The reason for the organization's termination or dissolution must be provided. This could include completion of the organization's mission, bankruptcy, merger with another organization, or other circumstances.

5. Final annual return: The form requires the organization to indicate if they have filed a final annual return (either Form 990, 990-EZ, or 990-PF) for the year in which the termination or dissolution occurred.

6. Assets remaining upon termination: The IRS requires information about any remaining assets of the terminated organization. This includes cash, investments, and any other property held by the organization at the time of termination.

7. Distribution of assets: The organization must provide details on how its assets were distributed upon termination. It is important to specify the recipients of the assets and the specific amounts or types of assets distributed to each.

8. Responsible party information: The form requires the name, address, and contact information of the person responsible for answering any additional inquiries regarding the terminated organization.

9. Authorized signature: The individual completing the form must sign and date it to certify the accuracy of the information provided.

It's important to note that the specific reporting requirements may vary depending on the state in which the organization is registered. It's advisable to refer to the instructions provided by the IRS and the relevant state authorities while completing Form ARTS-GS.

Can I create an electronic signature for signing my form arts gs in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your articles of incorporation of a general stock corporation form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit arts gs form straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing arts gs right away.

How do I fill out the art gs form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign general stock articles form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.